nassau county income tax rate

Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund.

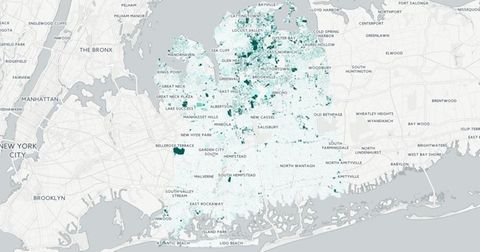

Nassau County S Property Tax Game The Winners And Losers

What is the sales tax rate for Suffolk NY.

. Taxes are up for veteran Donald Patane in Levittown too. Town of Hempstead Receiver of Taxes. 2 days agoOn February 7 2022 the Nassau County Legislature passed a local law extending the period to file an assessment challenge for the 202324 tax year from March 1 2022 to April 30 2022.

The steep NYC Income Tax surcharge in addition to Fedeal and NY State income taxes is also why some New Yorkers are tempted to cheat a. Other municipal offices include. How are Long Island taxes calculated.

The Nassau County Tax Collector is committed to an ongoing process of providing accessible content to all website visitors. Answer 1 of 4. Here are some of the important tax exemptions you should know about if you own a home in Nassau County.

- The Income Tax Rate for Nassau County is 65. We welcome feedback on ways to improve the sites accessibility. As a reminder real property taxes represent one of the largest expenses of owning or leasing a property.

I had paid a NYC Commuter Tax until 1999 now good riddance. What is the sales tax rate for Suffolk NY. Nassau County is ranked 4th of the 3143 counties for property taxes as a percentage of median income.

Nassau County New York sales tax rate details The Nassau County sales tax rate is 425. Depreciation varies with equipment however typical non-high-tech equipment will be initially assessed at 94 of value with an annual 12-year depreciation to a base of 29 of value. Income and Salaries for Nassau County- The average income of a Nassau County resident is 42949 a year.

The average yearly property tax paid by Nassau County residents amounts to about 826 of their yearly income. Municipalities None 6 sales and use tax applies to. Nassau County Senior Citizen Property ExemptionA Complete Guide.

New construction is now taxed at a higher rate in Nassau County after reassessment. Nassau County property tax rate is one of the highest in New York state but if you are 65 or older you may be eligible for a Nassau County senior citizen property exemption. 164 rows 6242021.

Nassau CountyMunicipalities based on assessed value of depreciated property and taxed at effective mileage rate. Purchases of tangible personal property made in other states by persons or business entities for use in Florida Manufacturers on the cost price of products removed from inventory for their own use. The lowest effective tax rate in the state was 393 per 1000 levied on homes and businesses in the Sagaponack school district portion of the Suffolk County town of Southampton.

There are exemptions for veterans senior citizens volunteer firefighterambulance workers or people with limited income and disabilities. The US average is 46. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65.

You can use the New York property tax map to the left to compare Nassau Countys property tax to other counties in New York. I am adamantly opposed to the proposed law which will 1 raise gas taxes 55 cents to 9812 cents per gallon which will make New Yorks gas tax 57 higher than the state. Does Nassau County have income tax.

Your marginal federal income tax rate remained at 2200. Applications are accepted throughout the year. Town of North Hempstead.

The US average is 28555 a year. Exemptions can help reduce your taxes often by a considerable margin. Are taxes going up in Nassau County.

Your effective federal income tax rate changed from 1000 to 981. Does Nassau County have income tax. Nassau County 1 local option.

How do I calculate my Nassau County taxes. Para asistencia en Español llame al 516 571-2020. What is NY state tax on income.

Nassau County uses a simple formula to calculate your property taxes. INCOME PERCENT EXEMPTION Income is to be reported on the basis of the preceding. Total Estimated 2020 Tax Burden Income Tax 12650 Sales Tax 1336 Fuel Tax 237 Property Tax 5771 Total Estimated Tax Burden 19993.

What is Nassau County NY sales tax. What town has the lowest taxes on Long Island. Claim the Exemptions to Which Youre Entitled.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. The tax receiver multiplies the rates for the districts in which your property is located by the assessed value of your property to determine your bills for school and general taxes. This guide will help you understand the purpose of property tax exemptions and show you how to lower property taxes with the help of.

The US average is 46. It is 865 percent for Nassau County when it comes to sales tax. The US average is 46.

Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. - Tax Rates can have a big impact when Comparing Cost of Living. Nassau County Department of Assessment.

I support the Nassau County Legislative Majoritys call to stop Albanys proposed law S4264A A6967 which will increase taxes on gasoline and products to heat our homes. NYCs income tax surcharge is based on where you live not where you work. State 6 imposed upon the list below.

Assessed Value AV x Tax Rate Dollar Amount of Taxes. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. When may I file.

The US average is 46. Suffolk County New York sales tax rate details The Suffolk County sales tax rate is 425. Suffolk County New York sales tax rate details The Suffolk County sales tax rate is 425.

Your federal income taxes changed from 5693 to 5580. Applications received after the taxable status date of January 2nd will be processed for the following tax levy. The tax revenue required is divided by the assessed value of all property in the district to determine the tax rate.

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

New York Paycheck Calculator Smartasset

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

All The Nassau County Property Tax Exemptions You Should Know About

Make Sure That Nassau County S Data On Your Property Agrees With Reality